Axioma Risk Model Handbook

NEW YORK, March 12, 2020 /PRNewswire/ -- Qontigo, aninvestment intelligence leader and provider of best-of-breedanalytics and world-class indices, has announced the release of theAxioma North America Equity Factor Risk Model (AXNA4). This nextgeneration model includes additional market factors for superiorperformance and risk attribution analysis.

- Axioma Risk Model Handbook

- Axioma Risk Model Handbook Pdf

- Axioma Robust Risk Model Version 4 Handbook

- Axioma Robust Risk Model Handbook

- Axioma Risk Model

Axioma Risk Model Handbook

The new AXNA4 model covers roughly 10,400 securities for bothUnited States and Canadian marketsincluding ADRs and foreign listings of North American issuerstrading in other geographies.

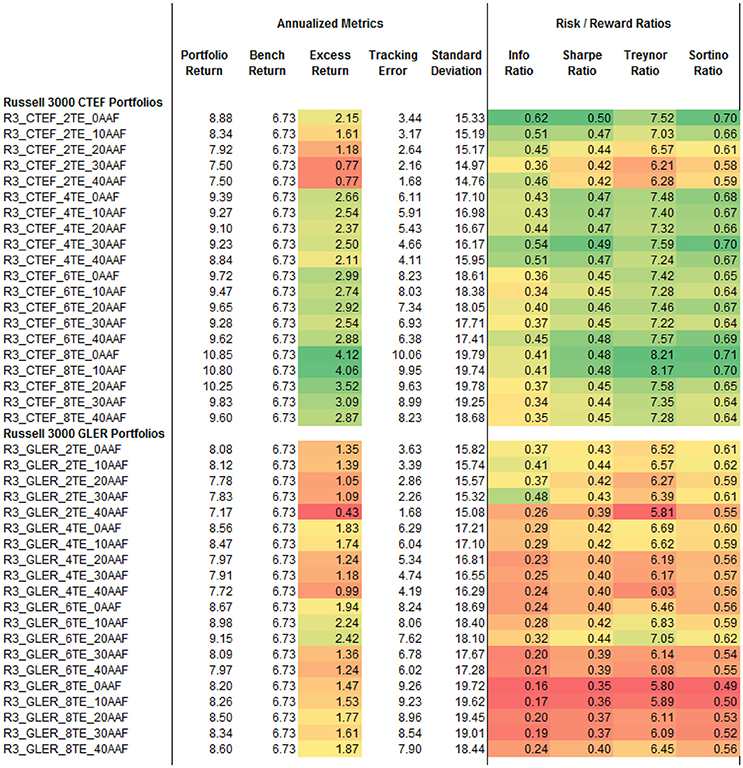

Customizable Risk Models Tailored to YourInvestment Process. The Axioma Risk Model Machine™ is a breakthrough tool that allows clients to build custom risk models easily. Custom risk models enable clients to achieve enhanced results because the models are tailored to the client’s own investment process. By aligning the factors in the risk model with the factors used in the returns model, unintended risk. For a detailed guide to Axioma's risk model methodology, we refer the reader to the Axioma Risk Model Handbook. And International portfolios are run with active risk ceilings set at 2, 4, 6, and 8%. Axioma, a global provider of innovative risk and portfolio management solutions, today launched the latest version of its Japan Equity Factor Risk Model suite (“AXJP4”). The Model provides improved methodologies, enhanced style factors and enriched exposures for its fundamental and statistical models, which all combine to deliver improved.

'Our latest North America modelstresses improvements to the structure and methodology of factors,'said Alessandro Michelini, ManagingDirector of Front Office Solutions at Qontigo. 'These enhancementsprovide investors with a clear understanding of factor exposuresacross a larger factor library.'

AXNA4 incorporates numerous enhancements including:

- Additional factors including Market Sensitivity, Profitabilityand Dividend Yield for informative and intuitive results

- Improved quality and stability of exposures

- New shrinkage estimator for firms with limited data to gainstable exposures for IPOs

- Enhanced portfolio analysis capabilities with stable andintuitive exposures for risk decomposition

- New outlier detection methodology for estimating factor returnsand refreshed model history available in the statistical model

Axioma Risk Model Handbook Pdf

The North America model is partof the Axioma Equity Factor Risk Model Suite built by experiencedresearchers and updated daily to provide the most comprehensiverisk and portfolio analysis to make more informed investmentdecisions.

About Qontigo

Qontigo is a financial intelligence innovator and a leader inthe modernization of investment management, from risk to return.The combination of the group's world-class indices andbest-of-breed analytics, with its technological expertise andcustomer-driven innovation, enables its clients to achievecompetitive advantage in a rapidly changing marketplace. Qontigo'sglobal client base includes the world's largest financial productsissuers, capital owners and asset managers. Created in 2019 throughthe combination of Axioma, DAX and STOXX, Qontigo is part ofDeutsche Börse Group, headquartered in Eschborn with key locationsin New York, Zug and London.

www.qontigo.com

View original content to downloadmultimedia:http://www.prnewswire.com/news-releases/qontigo-releases-enhanced-north-america-equity-factor-risk-model-301021872.html

Axioma Robust Risk Model Version 4 Handbook

SOURCE Qontigo

NEW YORK, June 20, 2019 /PRNewswire/ -- Axioma, the leadingglobal provider of enterprise risk management, portfolioconstruction and regulatory reporting solutions, has launched thenext generation of its Axioma Risk™ solution whichsignificantly enhances its Fixed Income and Multi-Asset RiskModels. These new, bottom-up risk models are constructed usingAxioma's proprietary methodology for modeling global fixed incomereturns across both developed and emerging markets. Thismethodology relies on a rigorous, research-based approach thatincorporates granular, company-specific data, down to the entitylevel, in order to produce highly accurate fixed income curves thatisolate data signals while reducing data noise.

Axioma Robust Risk Model Handbook

'Building meaningful derived issuer-specific curves and marketsurfaces to construct risk models is notoriously difficult,' saidIan Lumb, Axioma's Head of RiskSolutions. 'We have spent years cleansing and organizing theunderlying fixed income data to develop a proprietary methodologythat solves for the main challenges that exist in other fixedincome risk models and incorporated these techniques into AxiomaRisk.'

The new methodology for building credit spread curves andduration times spread (DTS) measures allows the Fixed Income andMulti-Asset models, available through Axioma Risk, to provide userswith a more granular and accurate view of entity-specific risk.This ensures that risk budgets are measured and monitoredaccurately, and that exposures from similar sectors or ratings arenot all assumed to have the same risk. This enhanced visibilityensures that portfolio managers, risk managers and central riskbook owners are able to model all corporate and non-corporatecredit risk accurately across their portfolios and to deconstructportfolio risk at a truly granular level.

'Sub-entities of the same parent company can trade verydifferently,' explains ChristophSchon, Axioma's Head of Applied Research, EMEA. 'If youtreat all entities the same across a given capital structure, thenyour fixed income risk model may be missing crucial informationthat can inform your investment process – things likediversification benefits and distressed assets. It is important tobe able to identify these elements and to model their impact.'

Through a smoothing process that relies on an internallydeveloped machine learning technique, Axioma Risk will alsoseparate out artificial volatility and reduce data noise.

Other new features of the next generation Axioma Risk FixedIncome and Multi-Asset Risk Models include:

- Decomposition all the way to cashflows

- Market-consistent pricing and analytics

- Granular risk factors that are aligned with investmentstrategies

- Improved full-revaluation stress tests and risksimulations

- Consistent classifications

Axioma Risk Model

As a best-of-breed risk solutions provider, Axioma continuallyreleases new updates to its risk models across both equities andfixed income. Existing users will be able to switch seamlessly tothe new best-in-class risk model while new users can directlyintegrate these models into their existing workflow using Axioma'sAPI-first technology.

About Axioma

Axioma provides an integrated suite of front-to-back investmentmanagement solutions to a global client base, including assetmanagers, hedge funds, insurance companies, pension funds, wealthmanagers and investment banks. Our award-winning services arecomprised of multi-asset enterprise risk management, portfolioconstruction, performance attribution, regulatory reporting andcustom index design. With over $10trillion in assets under management, our clients rely onAxioma's solutions for decision intelligence throughout the entireinvestment process across the front, middle and back office.Enabled by Axioma's market-leading technology from APIs to thecloud-native open environment of axiomaBlue™ and fullyintegrated content and analytics, our customers deploy Axioma'ssolutions to create competitive advantage – from risk to return.Learn more at www.axioma.com and follow us on Twitter andLinkedIn.

View original content to downloadmultimedia:http://www.prnewswire.com/news-releases/axioma-introduces-next-generation-fixed-income-and-multi-asset-models-in-axioma-risk-300872101.html

SOURCE Axioma